Bitcoin Spot ETFs Go Live

As most know, eleven separate Bitcoin spot ETFs went live yesterday in the first day of trading. It’s a monumental event, years in the making, that will be a key driver for bitcoin price across increased institutional and retail flows over the next epoch.

As most know, eleven separate Bitcoin spot ETFs went live yesterday in the first day of trading. It’s a monumental event, years in the making, that will be a key driver for bitcoin price across increased institutional and retail flows over the next epoch. Short-term, price impact will be more mixed depending upon initial ETF flows. We wanted to break down the market action so far as well as highlight some of the pros and cons of the ETF products.

The First Day

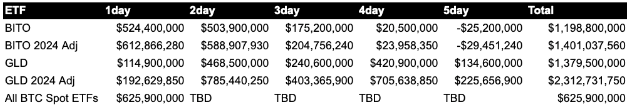

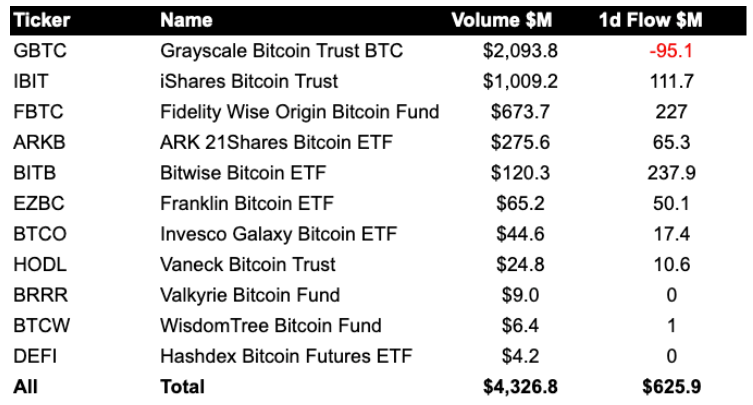

Across all ETFs, day one volumes were over $4.3 billion making this a record breaking day for ETF volume traded. That matters for future product liquidity but early interest is better measured in USD flows. First day flows came in at $625.9 million. Compared to previous products, the BITO bitcoin futures ETF saw $524M in flows in 2021 while GLD ETF had $192M back in 2004 both adjusted for inflation. Overall, market sentiment was expecting a higher pace of inflows on the first day.

Grayscale, BlackRock and Fidelity products were the initial volume winners as the market went with some of the most liquid and highest profile name products. Grayscale likely took a lot of the action because of their AUM size (over 600,000 BTC) despite having the highest fee of 1.5%. Many in the market who own GBTC have been eager to rotate into spot BTC, other ETF products or close out of arbitrage trades. GBTC had 95.1 million in outflows which weighed on the initial first day flows overall.

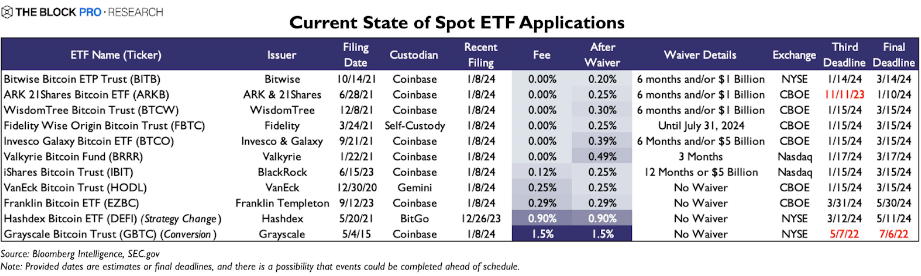

There’s been a fee war across the board driving fees to around 0.25% with no fee waivers for 6 months or until AUM hit a certain threshold. It’s a testament to not only the expected market demand for these products but also the opportunity to be the winning Bitcoin ETF in the market over the long-term. A majority winner is usually decided in the first week. Having the most liquidity is the key which creates more liquidity and attracts the largest players.

BlackRock’s IBIT is the likely candidate to be that majority winner based on their size and looking at volume traded after the first day. Fidelity’s FBTC is not far off second place.

The other major market impact happening right now is the rotation out of bitcoin related equities and into ETF allocations. Bitcoin public miner equities were down 15% in just the first day of ETF trading. Equities like MicroStrategy (MSTR) and Coinbase (COIN) are going through a similar drawdown despite bitcoin being nearly flat. We also expect continued rotation out of the BITO futures ETF as spot ETF is a better alternative.

For years, these equities have existed as pseudo-ETFs offering investors bitcoin exposure but that premium is now being quickly repriced.

ETF Cons

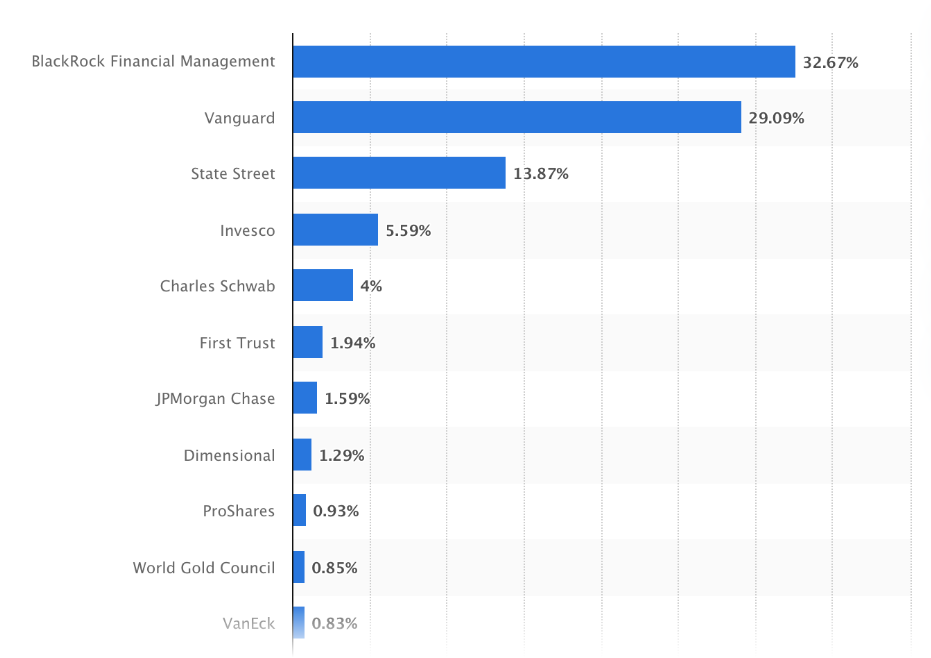

It was not all blue skies on the first day. Several known brokerages decided to not make any of the Bitcoin Spot ETFs available to their clients. Vanguard, being the largest, banned access to all products only allowing their customers to sell GBTC. Their disdain for bitcoin goes back to 2017. Having 29% market share of ETF assets across the largest providers of ETF in the United States, this a significant precedent and factor dampening initial interest. Many other brokerages reportedly haven’t initially offered clients access either. The market will sort this over time but having limited access to U.S. investors is a short-term concern and headwind.

Outside of the limited access to investors, an overall concern of the ETF products is that many use Coinbase custody which is yet another centralizing concern over the long-term. Locking up bitcoin in heavily centralized ETF custody products may be convenient for many now but don’t offer the same properties or advantages of non-ETF spot bitcoin. Many would argue that bitcoin in an ETF product is antithesis to bitcoin itself. Even backed by spot, ETF products are a bitcoin IOU offering investors the option to exchange only for the USD value of their ETF shares rather than outright ownership to the bitcoin instead.

Picking An ETF

For those looking for a reputable broker and product to get ETF exposure, the industry crowd favorite to access ETFs has been Fidelity. They not only have strong Bitcoin expertise and history in the space but are the only ETF product custodying bitcoin themselves. Fidelity was the first major asset manager to build a bitcoin research team and develop their long-term bitcoin thesis. FBTC Fidelity Wise Origin Bitcoin Trust has strong volume and liquidity relative to all products through the first day of trading and has all fees waived through July 2024. Their fee post waiver period will still be competitive at 0.25% and will likely come down as other products bring fees lower. They may not beat out BlackRock iShares Bitcoin Trust in AUM and volume as the majority winner but is our preferred ETF product for investors looking to get additional ETF exposure.

Closing The GBTC Trade

With the approval and conversion of Grayscale Bitcoin Trust to an ETF, the discount has nearly fully closed. This was our biggest and most successful trade for investors over the last year allocating to GBTC in 2023 at an average price of $11.83. Now that the trust has converted, we are starting to rotate out of the position in preparation for other bitcoin bull market opportunities.

What’s Ahead?

Bitcoin ETFs are here to stay despite the conflicting opinions surrounding self-custody bitcoin or Vanguard’s and the SEC’s efforts to limit the ETF path to market. SEC Commissioner, Hester Peirce wrote a statement piece about the Bitcoin ETF approvals saying it best,

“...by failing to follow our normal standards and processes in considering spot bitcoin ETPs, we have created an artificial frenzy around them.”

That’s exactly what we’re expecting to see this year in 2024. The first day was certainly a frenzy and we only expect interest to rise as the market becomes more familiar with these products over time.

In the short-term, price will depend on initial flows and may disappoint relative to market expectations following a ~200% rally from November 2022 lows front running ETF demand. Yet, over the next two years and broadly over the long-term, we expect the ETFs to be a driving force for increased market adoption beyond what gold was in the 2000s. The investing world is still ETF dominant and even modest projections of bitcoin taking over just 0.5% to 1% of all ETF assets will have a major impact on price appreciation this cycle.