BTC Market Update - Gamma Squeeze Edition

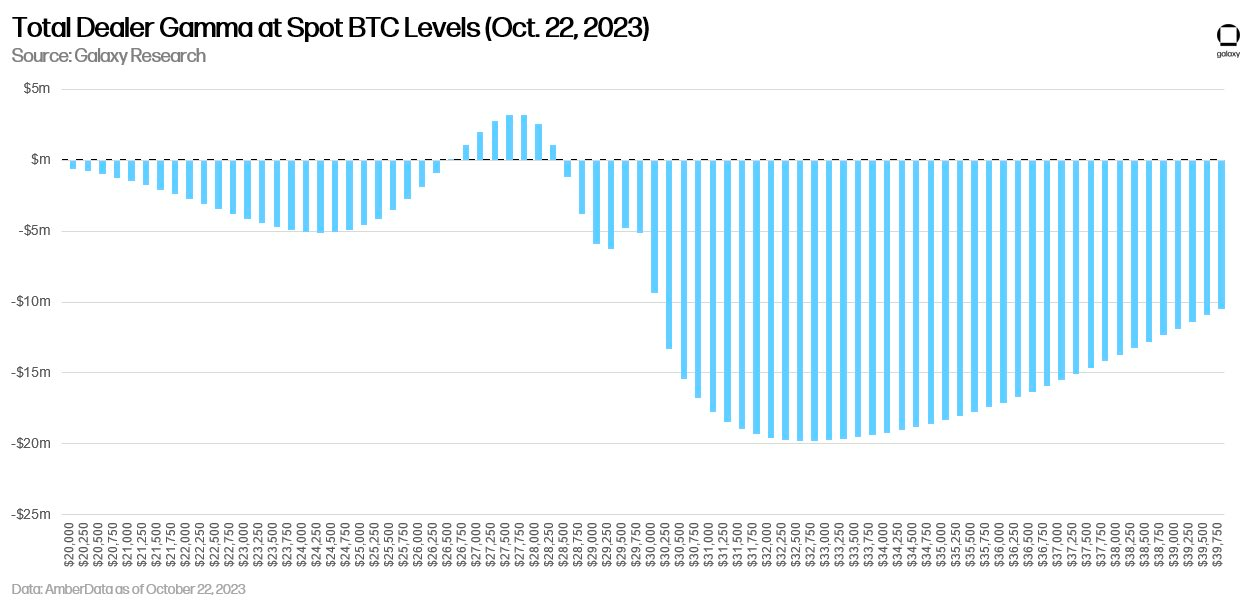

The recent surge in the price of bitcoin can be attributed in large part to intricacies within the options market, specifically a gamma squeeze for those short out of the money bitcoin call options. This dynamic was one of the contributing factors for bitcoin’s muted volatility and range-bound price action for much of the 2023 year to date. For those less acquainted, ‘gamma’ measures how much the exposure, or ‘delta’, of an option changes with the price movement of the underlying asset—in this case, bitcoin—varies. When traders and market makers are “short gamma”, they’re compelled to incrementally buy the underlying asset as its value rises in order to maintain balance. Research from Galaxy Digital brought to light that this gamma-driven dynamic was particularly prominent as bitcoin passed the $28.5k threshold and grew increasingly influential as prices approached and exceeded $32.5k. This led to a cascading effect, inducing market participants to augment their bitcoin purchases, which in turn accelerated the price increase.

While this gamma activity played a starring role, other variables contributed to the bullish sentiment. The market was rife with speculation about possible bitcoin spot ETF approvals and significant shifts in bitcoin liquidity became evident. New developments such as BlackRock’s disclosure that they may begin seeding a Bitcoin ETF as early as October, and the publication of the iShares Bitcoin Trust ticker ‘IBTC’ on the DTCC site, added fuel to the fire. Furthermore, the finalized mandate between Grayscale and the SEC suggests an increasingly favorable regulatory environment for bitcoin spot ETFs, thereby boosting market optimism.

The market disruptions in 2022, which had significant impacts on various market makers and trading desks, led to a shortage of conventional bitcoin lending avenues. This scarcity nudged several to explore the options arena, predominantly gravitating towards call option selling as an income generation strategy, which grew in prominence as the year progressed. With Monday’s large move, this tactic masterfully backfired, fueling the uptrend even further, imposing growing losses on the entities engaged in such a trade.

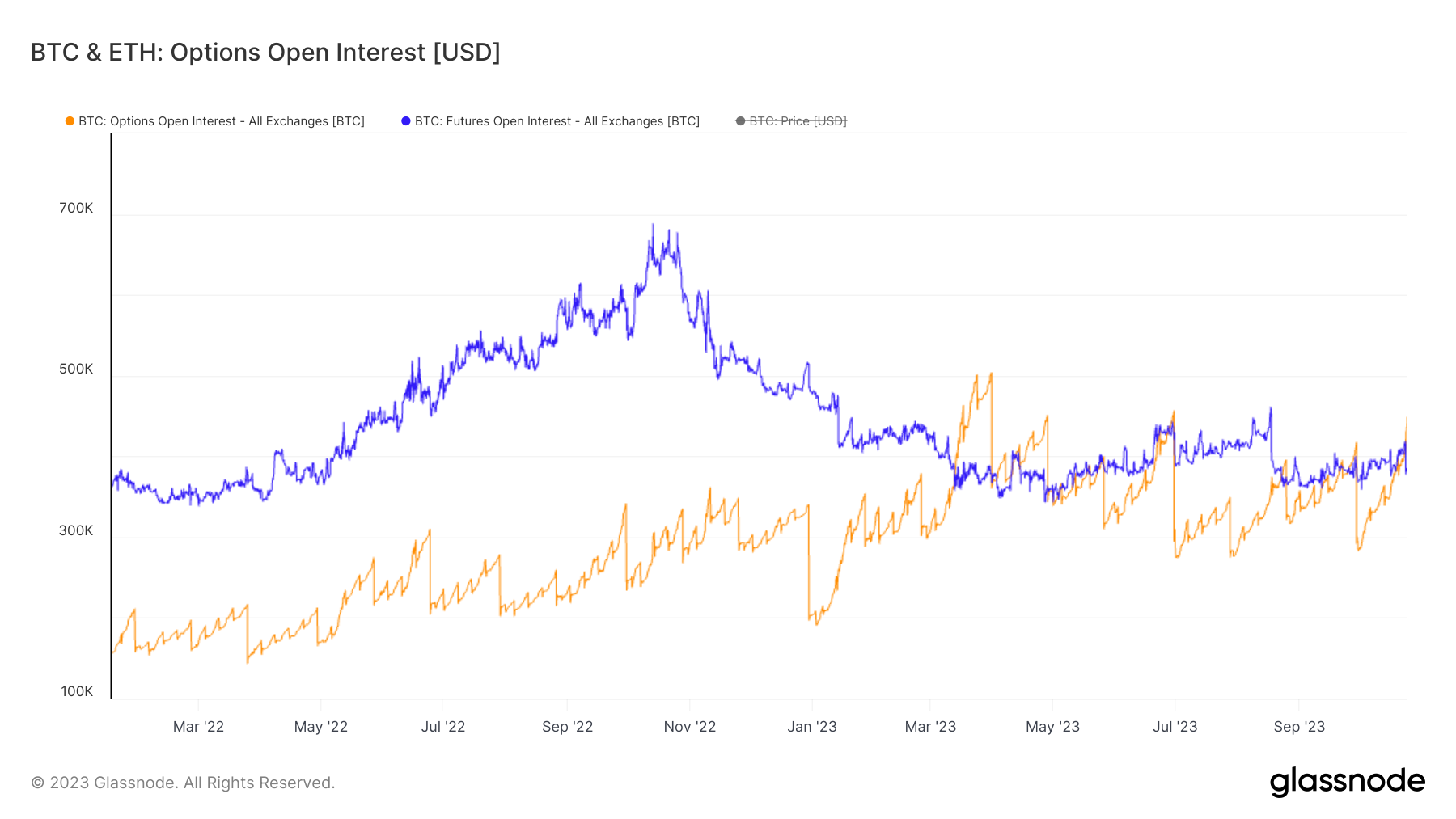

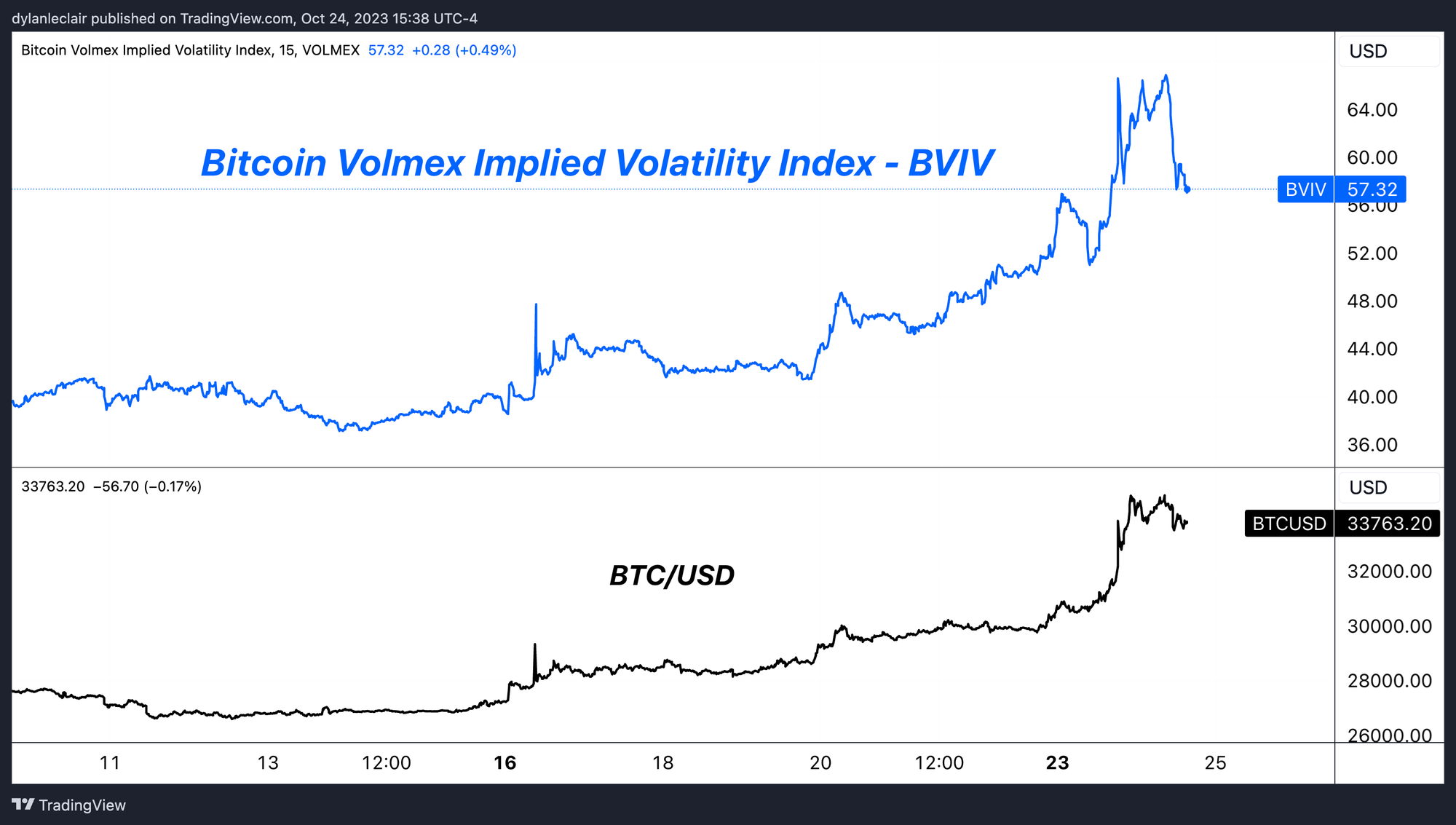

During the turbulence, bitcoin implied volatility was sent on an aggressive upward trajectory, further intensifying the pressure on those short calls in the options market and short outright in the futures market. It’s worth noting the ascendant dominance of the options market when compared to bitcoin futures. The notional open interest for bitcoin options has overtaken that of the futures market, indicating that the former is becoming a more pivotal player in our ongoing market analysis.

In summary, while the potential ETFs may have stirred the market waters, it was the pronounced gamma activity within the options space that was the primary catalyst for bitcoin’s robust price movement. We expect positive news flow in the coming weeks/months ahead regarding the approval of a spot bitcoin ETF, and are positioned accordingly.”